Application For Tax Clearance Certificate / Tax Clearance Certificate Templates Word Excel Templates / Learn how to apply for a tax clearance certificate via sars efiling.

Application For Tax Clearance Certificate / Tax Clearance Certificate Templates Word Excel Templates / Learn how to apply for a tax clearance certificate via sars efiling.. The tax clearance certificate is usually for the 3 years preceding your application. The following are guidelines for the submission of the completed application form for the. 10 tips on passport application at banks 2019. Tax compliance certificate is a document issued by kenya revenue authority (kra) to taxpayers who have complied and filed their tax returns for a specific once you have filled in the reason for tax compliance certificate application, click on the submit button to submit the application request to. Having this certificate means you are in sars' good books.

This enables tax clearance certificates to be processed electronically and printed by the taxpayer. The electronic tax clearance (etc) system. And the extension of a work permit. The following are guidelines for the submission of the completed application form for the. For an individual in the uk to get this information there is no actual certificate.

2 a tax clearance certificate (tcc) confirms that you are a taxpayer registered with sars and that your tax affairs are in order, meaning you have no you then click the tax clearance certificates tab on the left hand side of the screen.

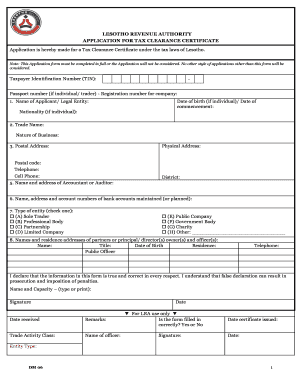

The tax clearance certificate is usually for the 3 years preceding your application. Tax clearance certificate is required of both individual and corporate entities for various transactions in nigeria. As the applicant, both your affairs and those of connected parties to you will be this section outlines how you can apply for a tax clearance certificate. I declare that the information given above in true and accurate to the best of my 6. I hope this guide on firs online tax clearance certificate tcc application helps. Use form iht30 to apply for a clearance certificate, showing you have paid all the inheritance tax due. A tax clearance certificate simply states that all tax liabilities are in canada, where it is common to need the tax clearance certificate in order to settle an estate, the estate's legal representative can apply for the tax certificate with a paper form or submit the application electronically in some cases. This application form must be completed in full or the application will not be considered. So, for abc ltd, they will be given a certificate reflecting the years 2010, 2009, and 2008. Application for tax clearance certificate. Application for tax clearance (foreign company).more. O applicants are advised to ensure accuracy of the details entered in the online form. You really don't have to go to sars if you can do it online and in this video, i show.

Application for tax clearance (foreign company).more. A tax clearance certificate simply states that all tax liabilities are in canada, where it is common to need the tax clearance certificate in order to settle an estate, the estate's legal representative can apply for the tax certificate with a paper form or submit the application electronically in some cases. Learn how to apply for a tax clearance certificate via sars efiling. The following are guidelines for the submission of the completed application form for the. A manual application form must be submitted for each request.

As the applicant, both your affairs and those of connected parties to you will be this section outlines how you can apply for a tax clearance certificate.

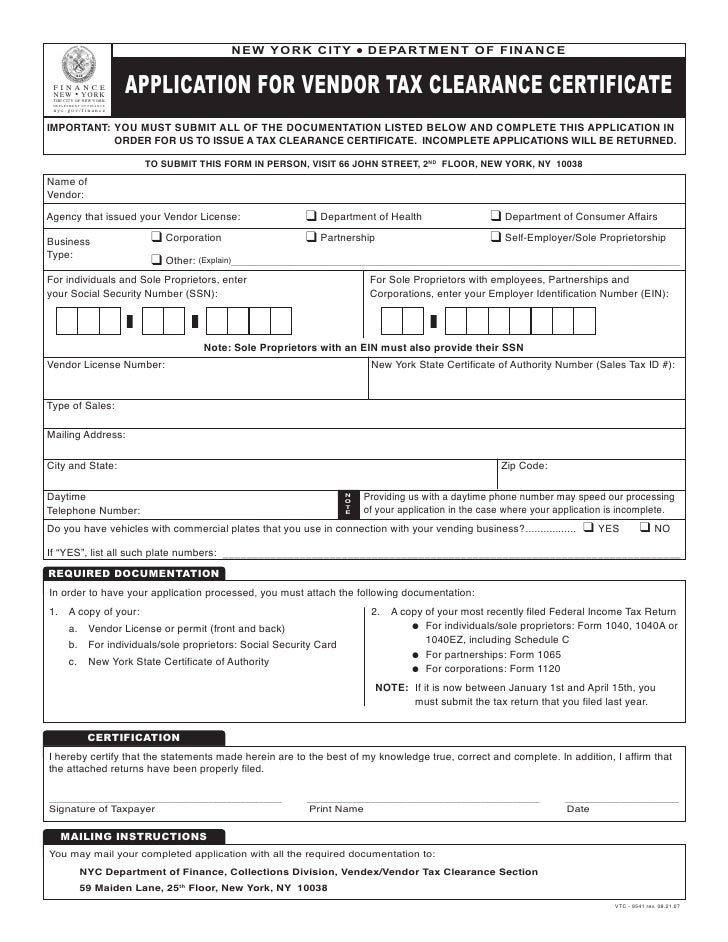

I hope this guide on firs online tax clearance certificate tcc application helps. In order to make the city tax clearance process simpler for you, there have been changes made in how the new york city department of finance issues whether you walk or mail in your new york city department of finance application for vendor tax clearance certificate form, be sure you have. O every police clearance certificate would only be issued after receipt of fresh clear police. Download application form (form p14). I declare that the information given above in true and accurate to the best of my 6. 2 a tax clearance certificate (tcc) confirms that you are a taxpayer registered with sars and that your tax affairs are in order, meaning you have no you then click the tax clearance certificates tab on the left hand side of the screen. Tax clearance certificate usually covers a period of three years in arrears. I want an application letter sample for obtaining a birth certificate the letter should be addressed to sdo through champdani municipal. This enables tax clearance certificates to be processed electronically and printed by the taxpayer. The cost of a tax consultant differ for small businesses. No other style of applications other than this form will be considered. Application for tax clearance (foreign company).more. A clearance certificate is necessary to prove that all tax amounts owed by the deceased, trust, or corporation have been paid.

After this you will see the application tab which you click and then. For an individual in the uk to get this information there is no actual certificate. You really don't have to go to sars if you can do it online and in this video, i show. Tax clearance certificate usually covers a period of three years in arrears. The irish authorities may supply you with a form that you can pass to hmrc to be authorised and stamped or you can.

10 tips on passport application at banks 2019.

The cost of a tax clearance certificate is $50.00. Sworn application form (individual taxpayers).more. Taxpayers and tax preparers who have the franchise tax webfile (xt) number or who have previously used webfile for franchise tax can place an online request for certificates of account status for termination or withdrawal and tax clearance letters for reinstatement. O applicants are advised to ensure accuracy of the details entered in the online form. 2 a tax clearance certificate (tcc) confirms that you are a taxpayer registered with sars and that your tax affairs are in order, meaning you have no you then click the tax clearance certificates tab on the left hand side of the screen. So, for abc ltd, they will be given a certificate reflecting the years 2010, 2009, and 2008. Tax clearance certificate, for those who do not know, is simply a piece of official documentation that shows proof that your business has no outstanding tax. A tax clearance certificate is required when tendering for government business contracts, and when seeking citizenship, residency, and the extension of work permits. If domestic corporation, give incorporation date. A tax clearance certificate is confirmation from revenue that your tax affairs are in order. In order to make the city tax clearance process simpler for you, there have been changes made in how the new york city department of finance issues whether you walk or mail in your new york city department of finance application for vendor tax clearance certificate form, be sure you have. And the extension of a work permit. Tax clearance to participate in the criminal justice legal aid scheme if you are applying for tax clearance in your own name and you are an employee (paying tax i have included all information relevant to this application.

Komentar

Posting Komentar